12 Benefits Seniors Get Only If They Know

A surprisingly big number of Americans have never claimed these benefits and special programs. Most are missing out simply because they don’t know about them. Here's a list of the top benefits available for seniors in 2021.

You could put an extra $5,000 or even $10,000 back into your pocket in 2021 by claiming the benefits listed below. Claim right away before they expire (some could be expiring as early as )

1. New Mortgage Relief Program Is Giving Up To $3,708 Back To Homeowners

Homeowners are advised to take advantage of a new Mortgage Give Back Program before it's gone. This is likely to be the largest benefit program American homeowners have seen.

When homeowners visit this Mortgage Relief Program's website they may be surprised to find out they qualify for a $3,708/year ($309/Month) mortgage benefit starting as soon as this .

Most homeowners will see huge savings and the process is very simple. This program can expire any day now, so we urge homeowners to see if they qualify for $3,708/year mortgage benefit today!

All homeowners can check for free to see if they qualify for this program and it takes just 2 minutes.

2. Get up to $250,000 In Life Insurance For Just $15/mo

If you have any family, life insurance is a must. Most people don’t have savings large enough for their family to pay off their mortgage, cover living expenses, and pay for final expenses — never mind ensuring your loved ones don’t inherit your debts.

Life insurance companies know all of this and the bigger the policy, the more they profit. They’ve been getting away with charging high rates for years – but that’s all coming to an end.

Fortunately, there is now a way to get a rock solid, yet very inexpensive life insurance policy from top providers. Thanks to this amazing website it’s easy to see and compare plans, regardless of age or medical history. The best part is it’s totally free to get a quote!

Even if you already have a policy, it can find comparable plans at a much much lower price. You could easily end up saving up to 70% on term life insurance!

No medical check and instant approval policies are also available.

Click Here To Learn More

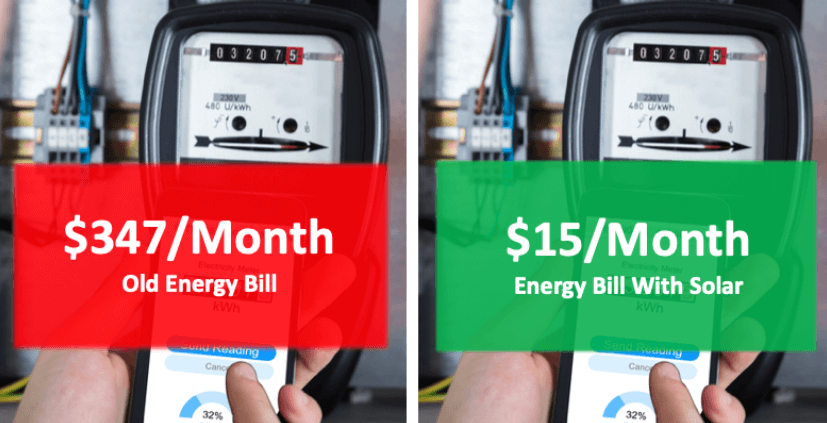

3. $0 Electric Bills? Federal Program Pays Homeowners To Go Solar

Did you know that some people are totally eliminating their power bills in 2021? Americans are taking advantage of a little-known government program which is paying them thousands to switch to solar. You are thinking what's the catch? The catch is that only some zip codes qualify for this program.

The program provides subsidies and rebates that can cover most of the costs associated with installing solar panels. In fact, the average tax break gives back over $5,000 for installing solar panels.

But the benefits don't end there. Once homeowners go solar, their energy bill is drastically reduced — often to $0 or close to it. It can save you thousands of dollars in the long run. You can bet the energy companies are not too thrilled about that.

It's very easy and completely free to check if your zip code qualifies. Homeowners can instantly check if their zip code qualifies for free and be on their way to eliminating electric bills.

Check If My Area Qualifies

4. Forgotten Stimulus Program Is Giving Up To $4,000 Back This (But You Have To Claim It)

Homeowners are being urged to see if they qualify for the Homeowner's Mortgage Relief program before it expires.

If you were born before 1985 and are currently a homeowner, this new program could give you up to $4,000 back per year in mortgage savings. You'll be shocked to see how much you could qualify for!

Its completely free to check and takes less than a minute, so it’s very much worth your time. Homeowners who have a mortgage balance of under $739,000 are more likely to qualify for a much larger cash out payment.

Pro Tip: A credit score of 600+, which is considered "Good" credit, can help you get the largest possible payout.

How To See If I Qualify?

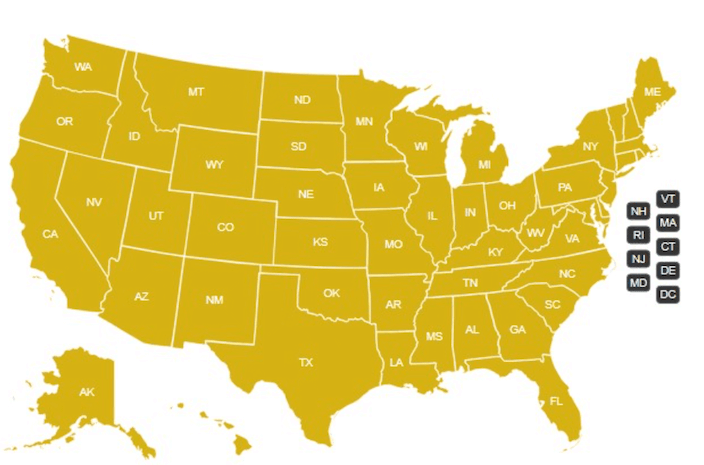

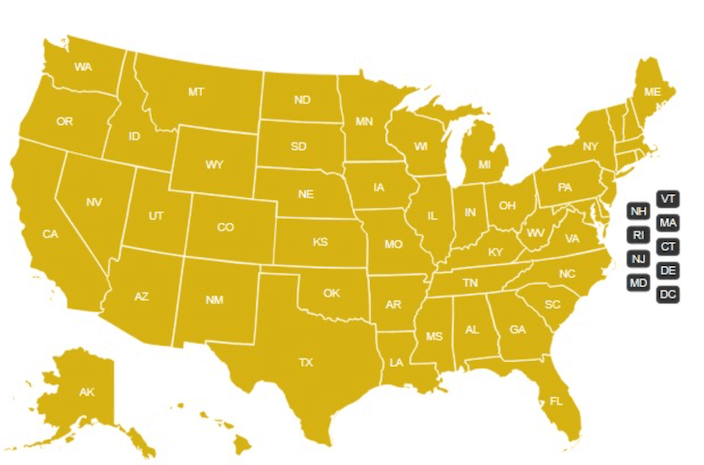

Step 1: Click here or on your state below to instantly check your zip code for free.

Step 2: Once you enter your zip code and enter some basic home info, you will be able to see if you qualify and how much you can save! It's really that easy!

5. Get a Discount on Groceries & Dining Out

- Albertsons: On the first Wednesday of every month, you may take 10% off your purchase (55+)

- Kohl’s: 15% off on Wednesdays (60+)

- Walgreens - up to 30% off every Tuesday (55+) with their Balance Rewards program

- Walmart: Walmart offers very few discounts to seniors. Some locations can offer reduced costs to seniors some days each week.

- Fred Meyer Senior Discount: 10% – 15%, depending on department, first Tuesday of each month for customers 55 or older.

- McDonald’s: discounts on coffee and beverages (55+)

- Subway: 10% off (60+) varies by location

- Chilli's: 10% off (55+)

- Walmart, Amazon, Kroger, Albertsons, Publix and many more stores - save up to 70% OFF with Easy Savings - read our review below.

6. Save up to 70% at Thousands of Stores When You Join Easy Savings

You might be throwing your money away if you are not a member of Easy Savings which can help you save up to 70% OFF from top brands and stores.

Americans who join Easy Savings get access to their members-only website where they can find thousands of discounts, coupons and deals which can help them save money at many popular stores like Walmart, Amazon, Kroger, Albertsons, Publix, Costco, Target, Aldi, Walgreens, CVS, Lowe's, Home Depot, KOHL's, Nike, Apple McDonalds, Starbucks and many other places.

You can save money at almost every store in United States. I was pleasantly surprised that Easy Savings saved me so much money at stores near my home, where I do most of my shopping.

We’ve tried Easy Savings and we love it. We have managed to save over $400 in our first month with Easy Savings. It was very easy to use. I see us easily saving $300 every month. You can literally save thousands of dollars each year paying for stuff you would have to pay for anyway. We can't wait to see how much we will end up saving next month.

If you want to save money on your everyday expenses, click here to read the full review of Easy Savings.

7. Homeowners Can Get up to $1,550 Back On Their Home Insurance

A new special program is helping thousands of savvy homeowners get up to $1,550/year back on their home insurance. Has your insurance provider told you about this?

The truth is that everyone needs homeowners insurance, and the insurance companies know that. But how often do you actually get to use your insurance? Most probably not enough to make up for the cost year after year. Home insurance should not be expensive.

Here’s something most people don’t know about home insurance: Homeowners insurance is actually inexpensive, but most people are paying way too much. In fact, most homeowners can now get an average $1,550 taken off their annual bill for the same or even better coverage than they have now at a much lower rate by using this popular website.

In just 30 seconds, you can search available rates from the top insurance providers that compete to give you the lowest rate allowing you to get a big discount on a great coverage. Many readers are reporting that they’re able cut their home insurance in half just by using this free website to compare quotes.

Get My Free Quote

8. Get A Huge Discount On Your Car Insurance (Save Over $600/year)

Did you know that depending on your age, driving record and other factors you could get a huge discount on car insurance?

If you’re paying over $50/month for car insurance, there’s a good chance you’re paying more than you need to. It’s quite common for this to occur, as most seniors simply keep their same old policy in place… and those rates can creep up over time without really noticing.

Most seniors are not taking advantage of the multiple discounts available to them when it comes to car insurance. And the reason is that most seniors don’t even know about these discounts. Click here to learn how you can save up to $600 on your car insurance.

9. Never Pay For Costly Home Repairs Out-of-Pocket Again

Unexpected home repairs can be catastrophic to the finances of most seniors who are on a fixed monthly budget. Your home insurance will not cover your refrigerator, stove or washing machine breaking down unexpectedly. Same goes for your heater in the winter or AC unit in the summer, if it breaks, you have to pay the heavy repair bill.

The good news is that there is now a new Home Warranty Program available for seniors that can help protect you from unexpected home repair bills & save you thousands on repairs. Appliances, AC’s, heaters, roofing repairs, etc. – they are all covered under the program. If they cannot fix it, they will replace it, its simple + saving seniors thousands.

Click Here To Learn More

10. Enjoy These Discounts When Eating Out

- Arby's - 55 and up get a 10% discount or a free drink

- Applebee's - 60 and up get 10% to 15% off at participating locations.

- McDonald’s: discounts on coffee and beverages (55+)

- Whataburger: free drink with purchase of a meal, depending on location (55+)

- Wendy’s: give free coffee or other discounts depending on location

- Denny’s: offers a 55+ menu with smaller portions, and better prices

- IHOP – 10% discount (55+) and a menu for people aged 55 and over at participating locations

- Subway: 10% off (60+) varies by location

- Papa John’s Senior Discount: check with your local stores (no standard senior discount policy)

- KFC: free small drink with any meal depending on location (55+)

- Burger King: 10% discount on purchase depending on location (60+)

11. Homeowners Are Using This New “Roof Replacement” Service To Get a New Roof

Homeowners should never have to pay full price for roof repairs again. In the past roofing work could cost a fortune. Worse yet, a bad roof can lead to tremendous damage, mold, animal infestation and other expensive situations that could be avoided with proper home maintenance.

No doubt replacing a home’s roof is an easy thing to put off “until next season,” especially since traditionally the cost could come with quite the price tag.

But thanks to this brilliant new website, it no longer has to cost homeowners an arm and a leg to get the roof replaced or repaired. In fact, homeowners that use the site will never have to pay full price for roof repairs again.

Now homeowners can get their roof replaced while saving thousands of dollars in the process by taking advantage of all special discounts, rebates and incentives available in their area.

Every homeowner should check to see how cheap it can be to get a new roof in their area.

Enter ZIP to Check Eligibility Here

12. Time Is Running Out For Homeowners to Save $1000's A Year

Homeowners who have not filed for the National Energy Incentive are being reminded that the deadline could be approaching soon.

The program was setup by the current administration to return $1000's back into the pockets of homeowners. Homeowners that are accepted into the program will see their energy bills cut by as much as 93% every year. With so many Americans struggling right now, the savings will help with all sorts of bills and daily expenses.

Homeowners that missed out on the Discount Rate Stimulus will be happy they now have a second chance to get $1000's back.

The simple questionnaire takes about 30 seconds and the savings can be huge. Simply click the button below the map.

Remember: these special programs can easily save you $1000’s of dollars every year. Claim them before some of them expire this and start saving right away!

1. Go Solar And Reduce Your Electric Bill To $0

2. Get $250,000 In Life Insurance For $15/Month

3. Get up to $3,708/year Taken Off Your Mortgage

4. Save $536 On Your Car Insurance

5. Get a New Roof

6. Get $1,632/yr Back On Your Home Insurance

7. Never pay for home repairs out-of-pocket again